# rank_test2.R

# script to run a simple backtest comparing different ranking methods

# for a momentum based trading system

# remove objects from workspace

rm(list = ls())

# load required packages

library(FinancialInstrument)

library(TTR)

library(PerformanceAnalytics)

MonthlyAd <- function(x){

# Converts daily data to monthly and returns only the monthly close

# Note: only used with Yahoo Finance data so far

# Thanks to Joshua Ulrich for the Monthly Ad function

#

# args:

# x = daily price data from Yahoo Finance

#

# Returns:

# xts object with the monthly adjusted close prices

sym <- sub("\\..*$", "", names(x)[1])

Ad(to.monthly(x, indexAt = 'lastof', drop.time = TRUE, name = sym))

}

CAGR <- function(x, m){

# Function to compute the CAGR given simple returns

#

# args:

# x = xts of simple returns

# m = periods per year (i.e. monthly = 12, daily = 252)

#

# Returns the Compound Annual Growth Rate

x <- na.omit(x)

cagr <- apply(x, 2, function(x, m) prod(1 + x)^(1 / (length(x) / m)) - 1, m = m)

return(cagr)

}

RankRB <- function(x){

# Computes the rank of an xts object of ranking factors

# ranking factors are the factors that are ranked (i.e. asset returns)

#

# args:

# x = xts object of ranking factors

#

# Returns:

# Returns an xts object with ranks

# (e.g. for ranking asset returns, the asset with the greatest return

# receives a rank of 1)

r <- as.xts(t(apply(-x, 1, rank, na.last = "keep")))

return(r)

}

SimpleMomentumTest <- function(xts.ret, xts.rank, n = 1, ret.fill.na = 3){

# returns a list containing a matrix of individual asset returns

# and the comnbined returns

# args:

# xts.ret = xts of one period returns

# xts.rank = xts of ranks

# n = number of top ranked assets to trade

# ret.fill.na = number of return periods to fill with NA

#

# Returns:

# returns an xts object of simple returns

# trade the top n asset(s)

# if the rank of last period is less than or equal to n,

# then I would experience the return for this month.

# lag the rank object by one period to avoid look ahead bias

lag.rank <- lag(xts.rank, k = 1, na.pad = TRUE)

n2 <- nrow(lag.rank[is.na(lag.rank[,1]) == TRUE])

z <- max(n2, ret.fill.na)

# for trading the top ranked asset, replace all ranks above n

# with NA to set up for element wise multiplication to get

# the realized returns

lag.rank <- as.matrix(lag.rank)

lag.rank[lag.rank > n] <- NA

# set the element to 1 for assets ranked <= to rank

lag.rank[lag.rank <= n] <- 1

# element wise multiplication of the

# 1 period return matrix and lagged rank matrix

mat.ret <- as.matrix(xts.ret) * lag.rank

# average the rows of the mat.ret to get the

# return for that period

vec.ret <- rowMeans(mat.ret, na.rm = TRUE)

vec.ret[1:z] <- NA

# convert to an xts object

vec.ret <- xts(x = vec.ret, order.by = index(xts.ret))

f <- list(mat = mat.ret, ret = vec.ret, rank = lag.rank)

return(f)

}

WeightAve3ROC <- function(x, n = c(1,3,6), weights = c(1/3, 1/3, 1/3)){

# Computes the weighted average rate of change based on a vector of periods

# and a vector of weights

#

# args:

# x = xts object of simple returns

# n = vector of periods to use n = (period1, period2, period3)

# weights = a vector of weights for computing the weighted average

#

# Returns:

# xts object of weighted average asset rate of change

if((sum(weights) != 1) || (length(n) != 3) || (length(weights) != 3)){

stop("The sum of the weights must equal 1 and the length of n and weights must be 3")

} else{

roc1 <- ROC(x, n = n[1], type = "discrete")

roc2 <- ROC(x, n = n[2], type = "discrete")

roc3 <- ROC(x, n = n[3], type = "discrete")

wave <- (roc1 * weights[1] + roc2 * weights[2] + roc3 * weights[3]) / sum(weights)

return(wave)

}

}

currency("USD")

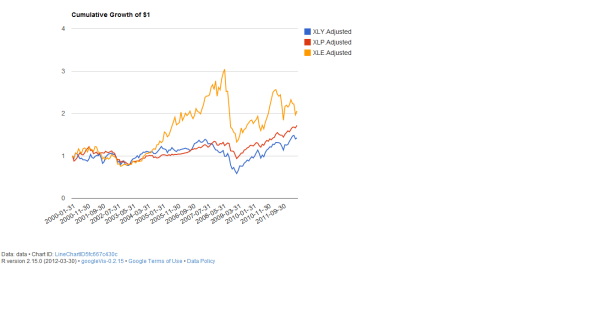

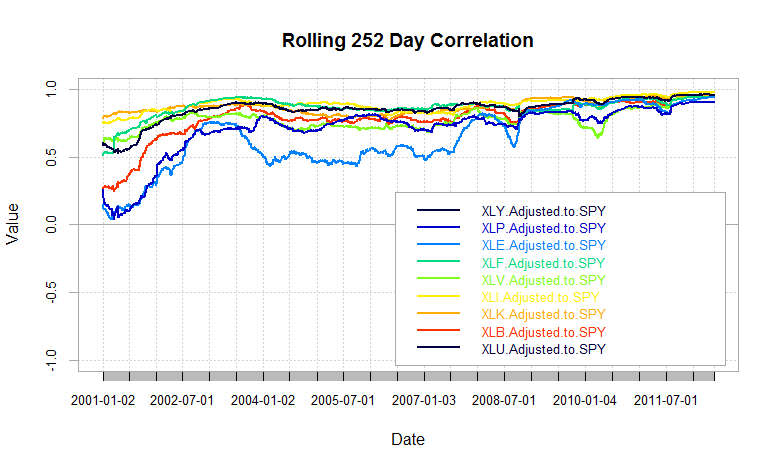

symbols <- c("XLY", "XLP", "XLE", "XLF", "XLV", "XLI", "XLK", "XLB", "XLU", "EFA")

stock(symbols, currency = "USD", multiplier = 1)

# create new environment to store symbols

symEnv <- new.env()

# getSymbols and assign the symbols to the symEnv environment

getSymbols(symbols, from = '2002-09-01', to = '2012-10-20', env = symEnv)

# xts object of the monthly adjusted close prices

symbols.close <- do.call(merge, eapply(symEnv, MonthlyAd))

# monthly returns

monthly.returns <- ROC(x = symbols.close, n = 1, type = "discrete", na.pad = TRUE)

#############################################################################

# rate of change and rank based on a single period for 6, 9, and 12 months

#############################################################################

roc.six <- ROC(x = symbols.close , n = 6, type = "discrete")

rank.six <- RankRB(roc.six)

roc.nine <- ROC(x = symbols.close , n = 9, type = "discrete")

rank.nine <- RankRB(roc.nine)

roc.twelve <- ROC(x = symbols.close , n = 12, type = "discrete")

rank.twelve <- RankRB(roc.twelve)

#############################################################################

# rate of change and rank based on averaging 6, 9, and 12 month returns

#############################################################################

roc.ave <- WeightAve3ROC(x = symbols.close, n = c(6, 9, 12),

weights = c(1/3, 1/3, 1/3))

rank.ave <- RankRB(roc.ave)

roc.weight.ave <- WeightAve3ROC(x = symbols.close, n = c(6, 9, 12),

weights = c(1/6, 2/3, 1/6))

rank.weight.ave <- RankRB(roc.weight.ave)

#############################################################################

# run the backtest

#############################################################################

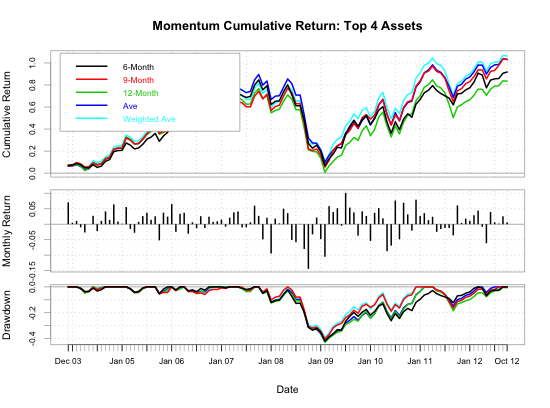

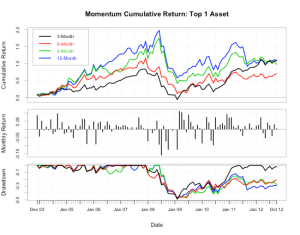

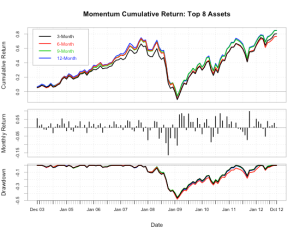

num.assets <- 4

# simple momentum test based on 6 month ROC to rank

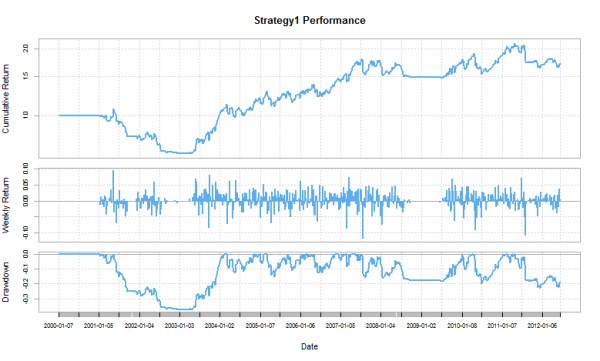

case1 <- SimpleMomentumTest(xts.ret = monthly.returns, xts.rank = rank.six,

n = num.assets, ret.fill.na = 15)

# simple momentum test based on 9 month ROC to rank

case2 <- SimpleMomentumTest(xts.ret = monthly.returns, xts.rank = rank.nine,

n = num.assets, ret.fill.na = 15)

# simple momentum test based on 12 month ROC to rank

case3 <- SimpleMomentumTest(xts.ret = monthly.returns, xts.rank = rank.twelve,

n = num.assets, ret.fill.na = 15)

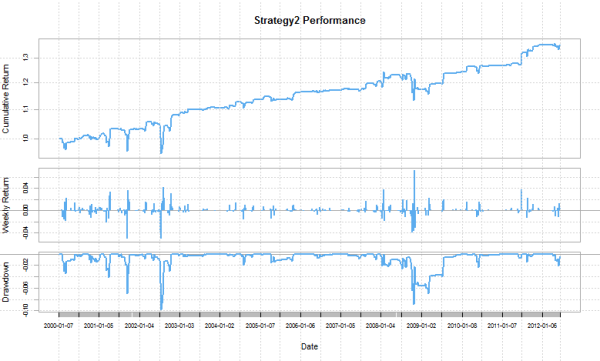

# simple momentum test based on average of 6, 9, and 12 month ROC to rank

case4 <- SimpleMomentumTest(xts.ret = monthly.returns, xts.rank = rank.ave,

n = num.assets, ret.fill.na = 15)

# simple momentum test based on weighted average of 6, 9, and 12 month ROC to rank

case5 <- SimpleMomentumTest(xts.ret = monthly.returns, xts.rank = rank.weight.ave,

n = num.assets, ret.fill.na = 15)

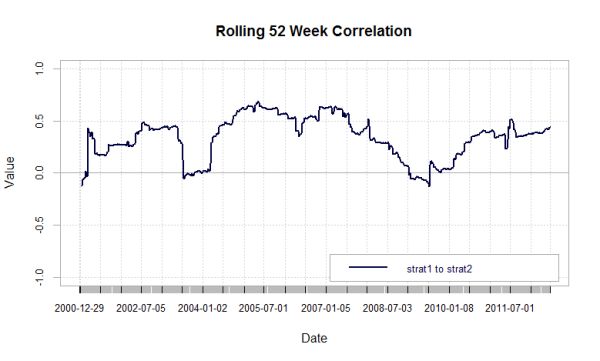

returns <- cbind(case1$ret, case2$ret, case3$ret, case4$ret, case5$ret)

colnames(returns) <- c("6-Month", "9-Month", "12-Month", "Ave", "Weighted Ave")

charts.PerformanceSummary(R = returns, Rf = 0, geometric = TRUE,

main = "Momentum Cumulative Return: Top 4 Assets")

table.Stats(returns)

cagr <- CAGR(returns, m = 12)

max.dd <- maxDrawdown(returns)

print(cagr)

print(max.dd)

print("End")